Frequently Asked Questions For New/Current Clients

Here are some general questions, rules, and regulations to follow and some ways to plan and protect your investments.

Resources

The IRS has an important message for tax payers with IRAs. IRS Publication 3125

The IRS defines a prohibited transaction as follows:

“Generally a prohibited transaction is any improper use of your IRA account or annuity by you, your beneficiary or any disqualified person. Disqualified persons include your fiduciary and members of your family (spouse, ancestor, lineal descendant, and any spouse of lineal descendant).”- Source IRS Publication 590-A and/or IRS Publication 590-B

Prohibited Asset Types, Disqualified Persons, and Prohibited Transactions:

A broad range of alternative investment options, which offer flexibility, are available to choose from for self-directed retirement accounts. There are rules that govern retirement accounts which self-directed investors must follow. The IRS rules which place some limitations on IRA investments relate to types of investments you can hold in a retirement account.

Prohibited Asset Types

IRS rules allow you to invest in any type of investment other than the following:

- Life insurance contracts

Collectables such as:

- Alcoholic beverages, artwork, or antiques

- Certain other tangible personal property considered to be collectible by the U.S. Treasury

- Coins (there are exceptions for certain U.S. Treasury minted coins)

- Gems

- Metals (there are exceptions for certain types of bullion)

- Rugs

- Stamps

- Stock of Sub-Chapter S-Corporations

Prohibited Transactions

The purpose of your retirement plan is to benefit you when you retire and not before. This is the reason that certain transactions are not allowed – if they are interpreted as providing immediate financial gain or current personal benefit to the account holder or other disqualified persons. Some prohibited transactions include:

- Sale or exchange, or leasing, of any property between a plan and a disqualified person

- Lending of money or other extension of credit between a plan and a disqualified person

- Furnishing of goods, services, or facilities between a plan and a disqualified person

- Income or assets of a plan being transferred to, used by, or used for the benefit of a disqualified person of the income or assets of a plan

- Act by a disqualified person who is a fiduciary whereby he deals with the income or assets of a plan in his own interests or for his own account

- Receipt of any consideration for his own personal account by any disqualified person who is a fiduciary from any party dealing with the plan in connection with a transaction involving the income or assets of the plan

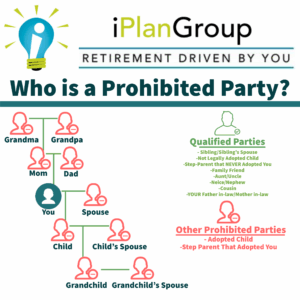

Disqualified Persons

- The IRA holder and his or her spouse

- The IRA holder’s lineal descendants (children, grandchildren, etc.) and their spouses

- The IRA holders lineal ascendants (parents, grandparents, etc.)

- Anyone providing services to the IRA

- Any corporation, partnership, trust, or estate in which a disqualified person(s) has a 50% or more combined ownership or is owned by multiple disqualified persons or disqualified entities

- Fiduciaries – the IRS defines a fiduciary as anyone who exercises any discretionary authority or control in the managing or administering of your retirement account, or in managing or disposing of its assets, or anyone who provides investment advice to your retirement account for a fee, or has the authority or responsibility to act in such a capacity

Internal Revenue Code Section 4975 restricts the types of investments and transactions that can be conducted inside a retirement account and governs the consequences if your retirement account conducts a prohibited transaction or owns a prohibited asset. For a full definition of prohibited transactions and disqualified persons under IRC 4975 click here: IRC 4975 – Prohibited Transactions and Disqualified Persons

Self-Dealing

The intent of your retirement plan is to benefit you when you retire and not before; therefore, transactions that the IRS interprets as providing current personal or benefit financial gain to you, your direct family, your business, or other disqualified persons are not allowed. Below are examples of self-dealing which would be considered prohibited transactions:

Real Estate

Your Retirement Account Cannot:

- Hold real estate that you or other disqualified persons live in or use in any way while the property is held in your retirement account.

- Purchase real estate owned by a family member of lineal descent (i.e. your father or mother).

- Real estate in your retirement account must be for investment purposes only.

Private Equity

Your retirement account typically should not purchase equity shares in a business/entity in which you (as the account owner) or a disqualified person or entity owns a majority share; or in which you or a disqualified person or entity holds a role of or similar to a managing member, has signing authority or check writing authority.

Extending Credit

Your retirement account cannot loan money to yourself or other disqualified persons.

Stepped Transactions

One or more transactions conducted leading up to making a prohibited transaction, such your IRA lending money to a non-disqualified person, who then lends money to their spouse, who then loans it to you personally. Whether done intentionally or accidentally, it is prohibited.

Consequences of Prohibited Transactions

There are possible severe consequences for you as the owner of the retirement account and for the other person(s) who participate in a prohibited transaction, including:

- The investment treated as a distribution, which may trigger a taxable event

- An early distribution penalty of 10% if you are under the age of 59½

- You may incur a 15% excise tax on the amount involved in the prohibited transaction

- You may be subject to additional penalties which can accrue for under-reporting for the years before the IRS discovers the prohibited transaction

Subscribe to Our Newsletter

Stay up to date on the latest from iPlanGroup.